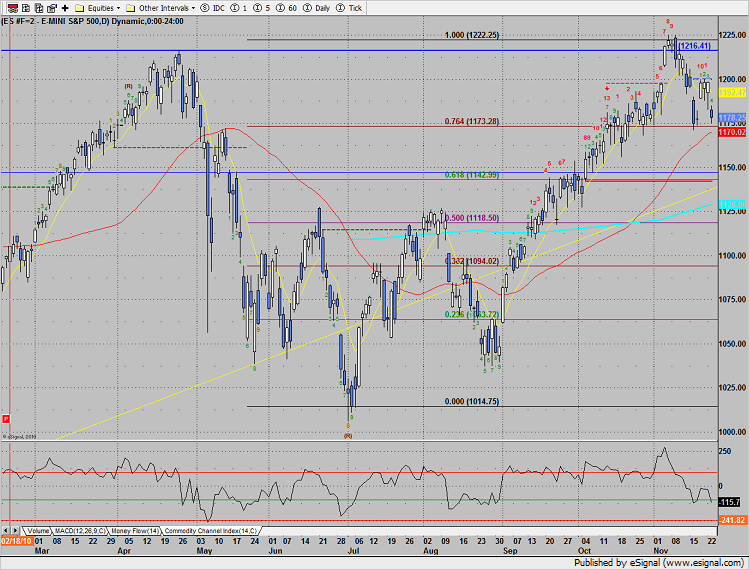

The SP lost 20 handles on the day, mostly from the news driven gap. The previous fair value area of 1198 has left an island pattern and trapped the buyers from that level. Key support remains at 1170(50dma).

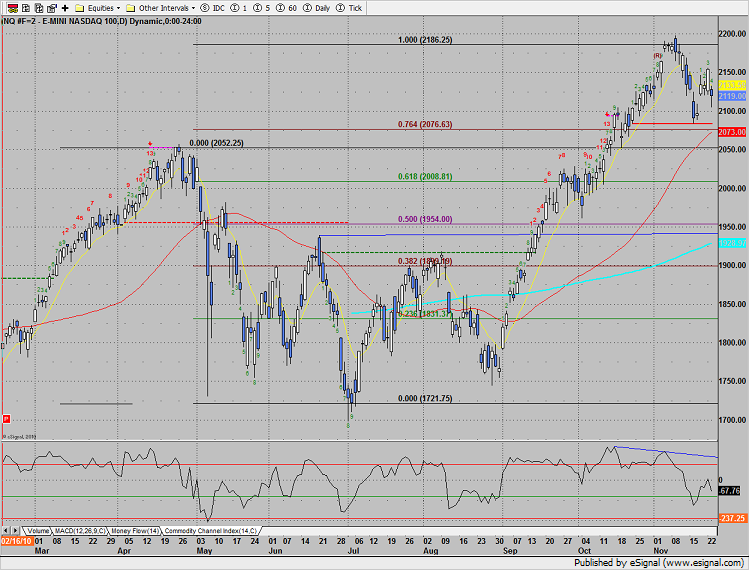

Naz was lower by 35, closing right at the 3 day low. Naz has a stronger pattern than the SP because it doesn’t have the island condition. The common piece in the construction is the large gap open below.

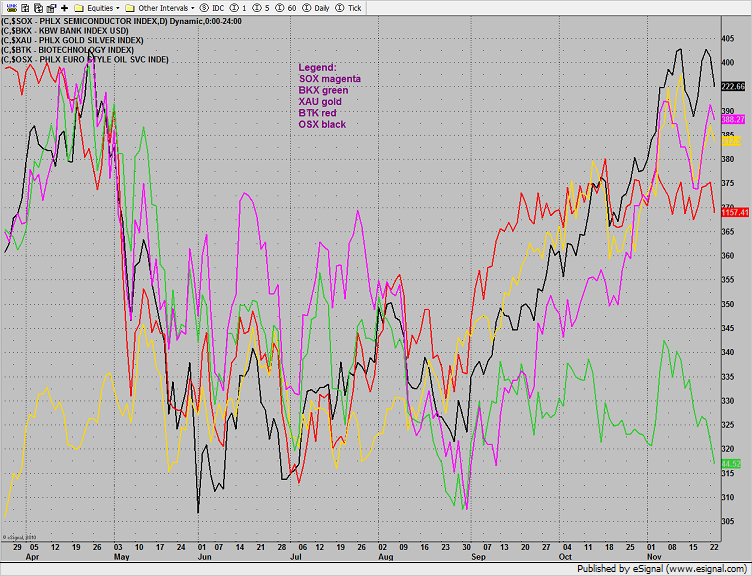

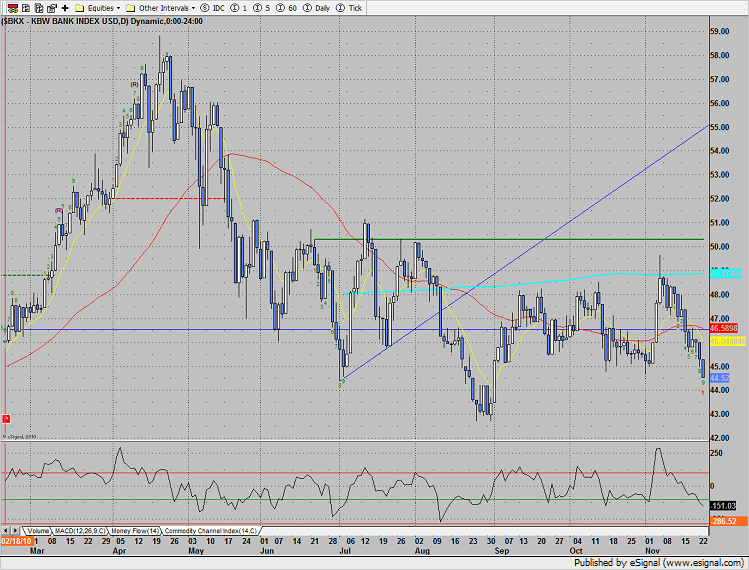

Multi sector daily chart shows the persistent weakness in the banks:

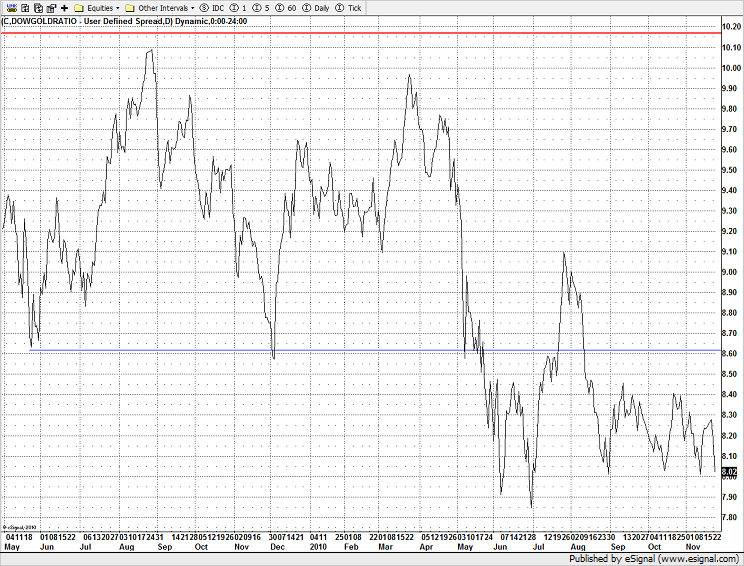

The Dow/Gold ratio is getting back near range low on the chart which illustrates the preference of gold over large cap stocks. A break to new lows in the ratio would be very bearish for stocks. In a secular bear market the ratio usually gives readings well below 5.

The 10-day Trin has recorded an oversold reading exceeding 1.35. The broad market is now oversold enough to support a multi day advance if it so chooses.

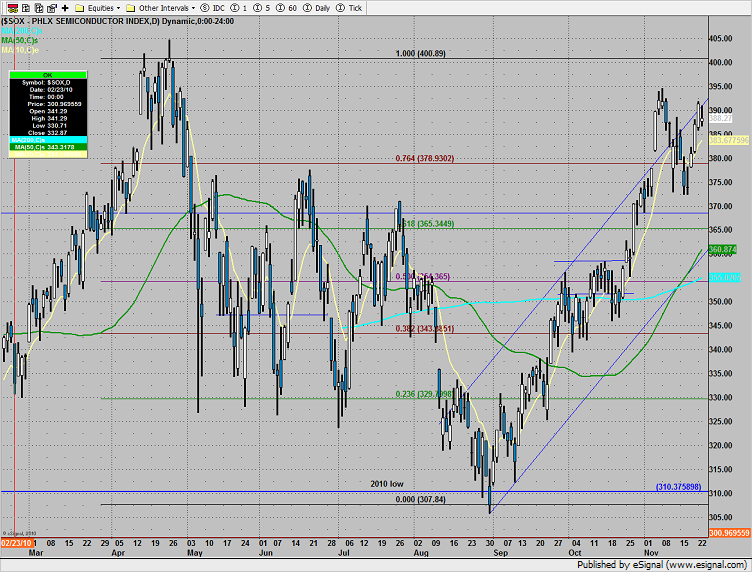

The SOX was the strongest sector but merely posted and inside day. Nothing new technically but there was notable relative strength on a weak day.

The XAU was also relatively strong vs. the broad market, posting an inside day.

The BKX recorded its 9th day down. Downside before some order of bounce or consolidation is not likely.

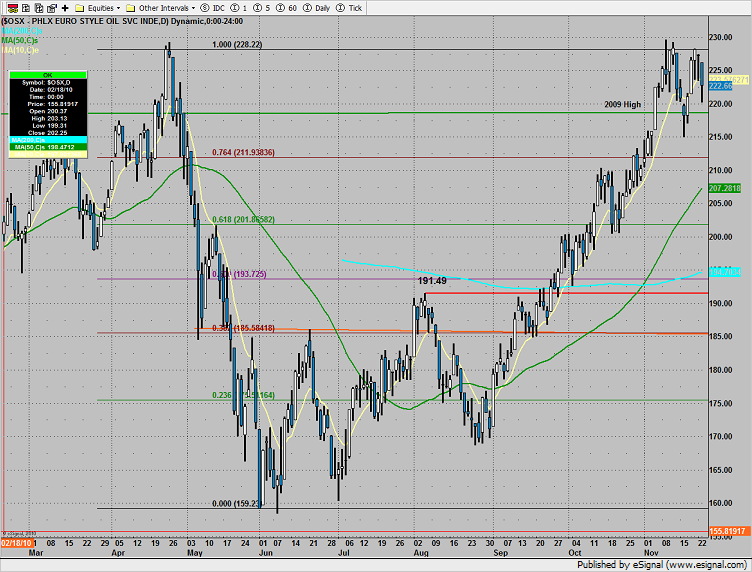

The OSX was the weakest sector losing a full 2%. A cup and handle is still in play unless 215 is lost.

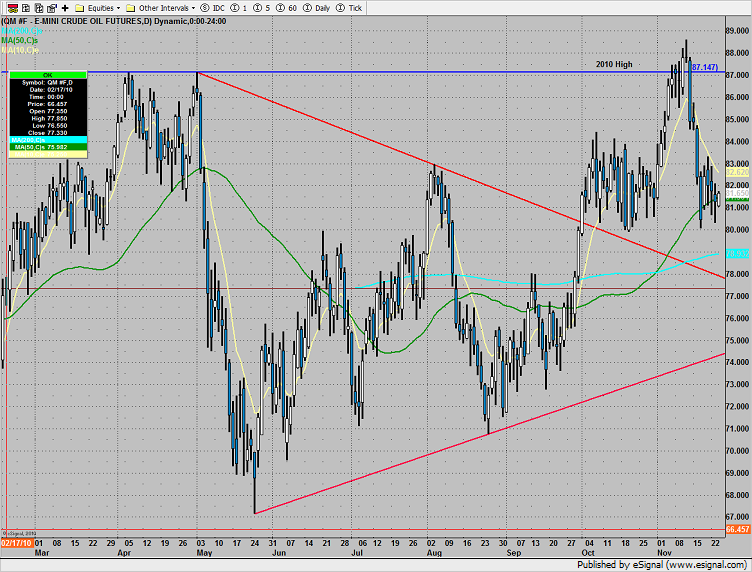

Oil continues to have key support at 80.

Gold was the strongest asset class bucking the dollar strength.