Another gap and go session as the ES came back to the magic 2062.50 level yet again (for the close essentially!). Volume started out strong but drifted off as we are now in “end of month/quarter/half year mode” as we have been expecting all week. We got to 1.9 billion NASDAQ shares.

Net ticks: -15 ticks.

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn’t work, triggered long at B and worked:

NQ Opening Range Play triggered long at A and worked enough for a partial only unfortunately:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

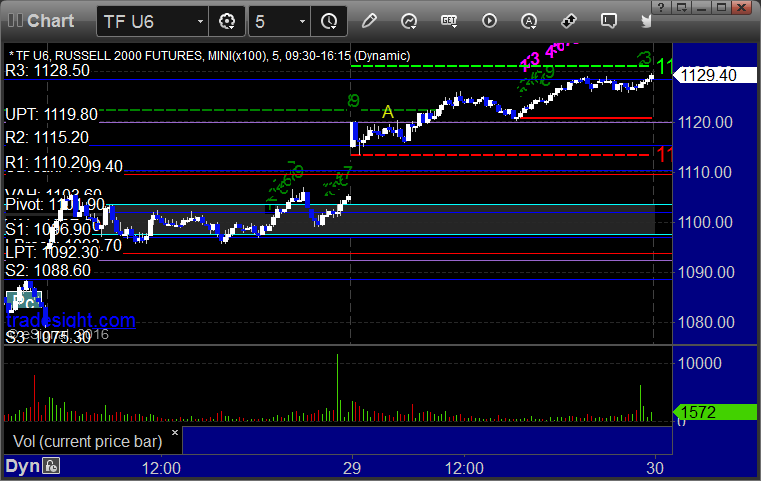

TF:

My call triggered long at A at 1120.20 and stopped for 8 ticks. At first, I put it back in, but when the futures faded, I canceled. It then triggered and worked: